Creating an intuitive AI powered ticker analysis

2024 | RAFA.AI

Introduction

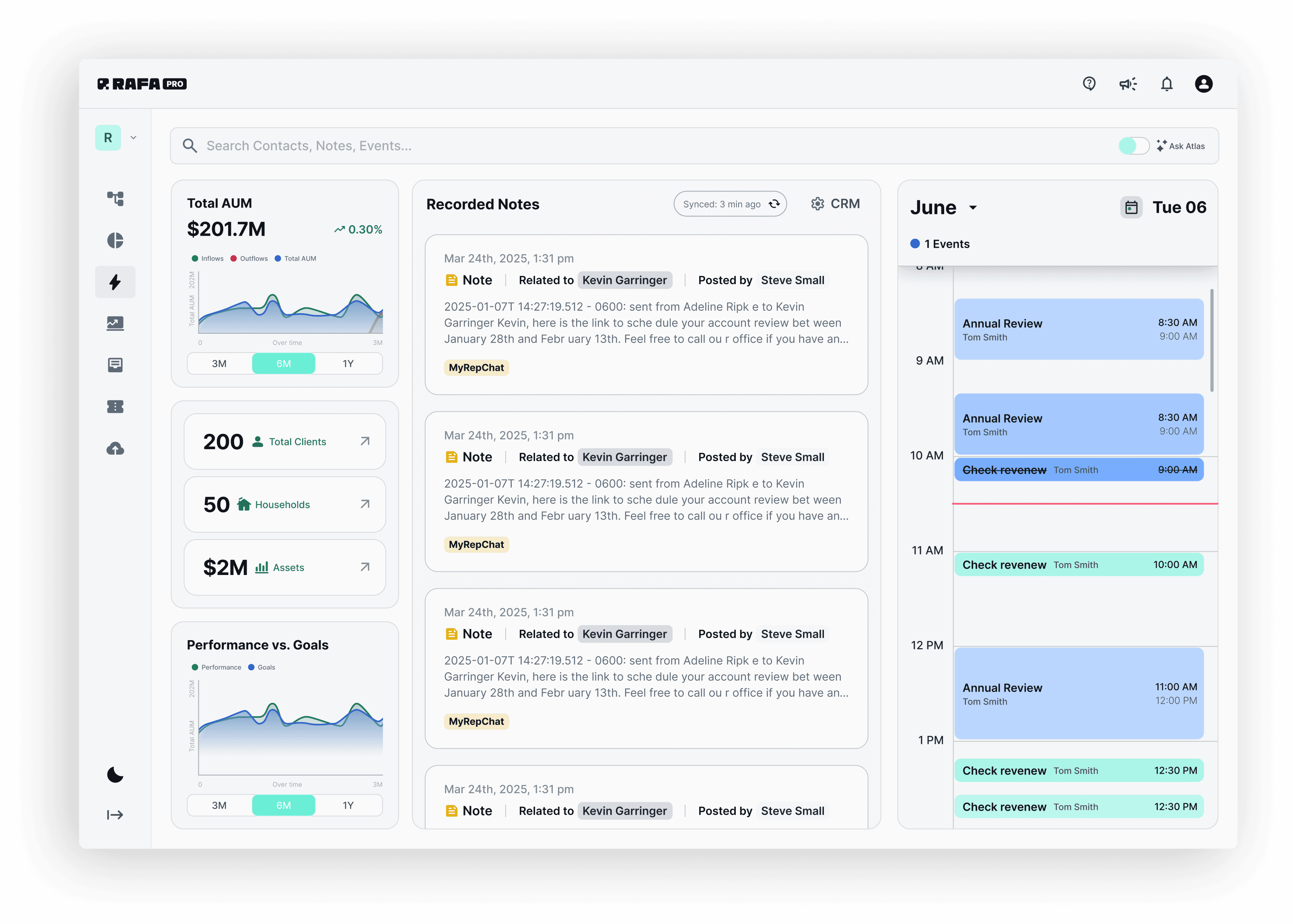

RAFA is a B2C mobile app that uses AI to help investors analyze stocks, ETFs, and crypto. In this case study, I’ll walk you through one of my biggest challenges as RAFA’s Main Product Designer: designing the ticker pages from scratch, keeping the depth of information while making analysis more intuitive and less overwhelming.

Context

Our target users are experienced investors, but even experts shouldn’t face cognitive overload. The goal of this feature was to present valuable AI insights clearly while addressing the unique data needs of stocks, ETFs, and crypto.

Since RAFA was still in its early stages, I started from the data gathered from beta testers by our UX Researcher and also relied on best practices, stakeholder input, competitor analysis, and my experience with data-heavy products.

The Problem

The Solution

I decided to structure the entire section as modular cards that could be opened to reveal more information. This matched the style of the rest of the UI and, most importantly, ensured layout flexibility. Each card needed to display specific data, thorough enough to be useful but not overwhelming, and remain highly visual.

Ticker Analysis Page, accessing from Portfolios. Final design, recording from the live version.

There are a lot of cards in this design that work together to give the user valuable information about the ticker that let's them action over it. Choosing what to show on each card was a process I worked with the PO, let's dive into two cards to talk about that process:

Analysts Opinions Card

A card designed to help users understand analysts’ opinions, projected target prices, and trend changes over time.

Card inside the Ticker Analysis and it's open version.

For this card, the PO had some initial ideas he sketched directly in code, which was a great starting point for a discovery meeting where I took some notes:

My notes and references over his initial draft.

Behind all this graphs there were some clear goals to communicate to the users:

Quickly assess market sentiment from analysts.

Show trend changes (more buys/sells over time).

Compare current price vs. price targets.

Use price targets to set their own risk/reward strategy.

Funny enough, the idea started in code and I continued it on paper.

After working in Figma I ended up with a two-section card. The first section shows analyst ratings, displayed visually in a colored graph with the leading opinion highlighted in the center. The second focuses on the target price, estimated from analysts’ projections.

All cards include an open version, that works like an information drawer an UI element part of our design system. In this case I added the price data over time to show how recommendations evolved, along with space for an AI Agent’s opinion and access to Learn articles, these elements only appear when available.

Final version of the card.

Intrinsic Value Card

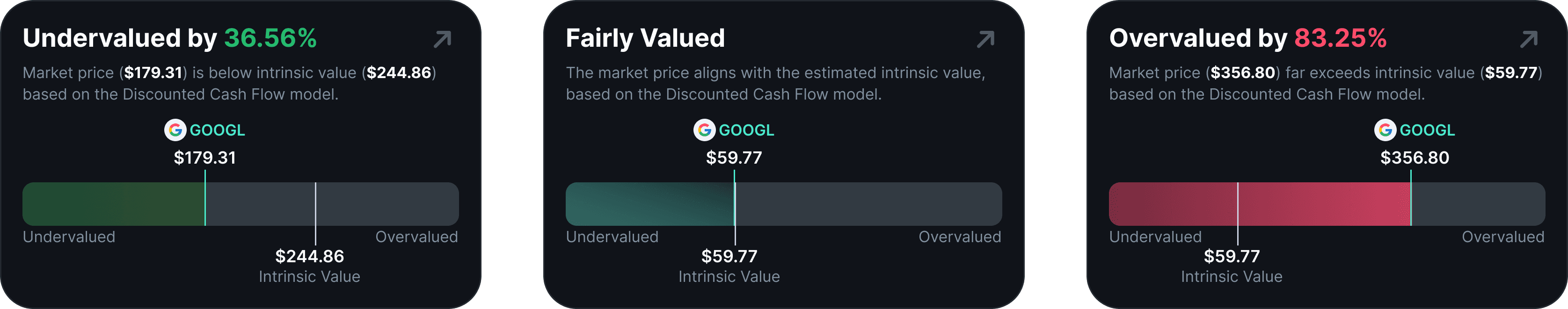

We wanted a card that could show users how the ticker was valued intrinsically, based on the Discounted Cash Flow model, and compare it to the market price. This would help them decide whether to enter, sell, or simply stay informed.

Card inside the Ticker Analysis and it's open version.

For the design I knew had two key values: Market and Intrinsic. And depending on the relationship between them, we had three scenarios:

Market < Intrinsic → Undervalued

Market = Intrinsic → Fairly Valued

Market > Intrinsic → Overvalued

I chose a clear, descriptive title instead of a generic Intrinsic Value label, the title directly communicated the state and percentage. I paired it with a simple bar graph that ranged from under- to overvalued, adaptable to tickers of different prices, and used color to make the valuation easier to read at a glance.

On the Open version I added Key Valuation Metrics that provide additional context.

Results

This project was part of RAFA’s V1 public release, following multiple alpha and beta stages. The new version had a strong impact on user engagement, with increases in both downloads and time spent in the app.

We tracked basic interaction data to understand early usage patterns, and the Ticker Analysis page quickly became the most visited feature. Around 80% of users’ on-screen time was spent there. These early results led to the next challenge: measuring specific in-page interactions and analyzing how users engaged with AI-driven conversations to uncover patterns in their investment behavior.