How I designed a B2B platform through strategic iteration and user feedback

2025 | RAFA PRO

Introduction

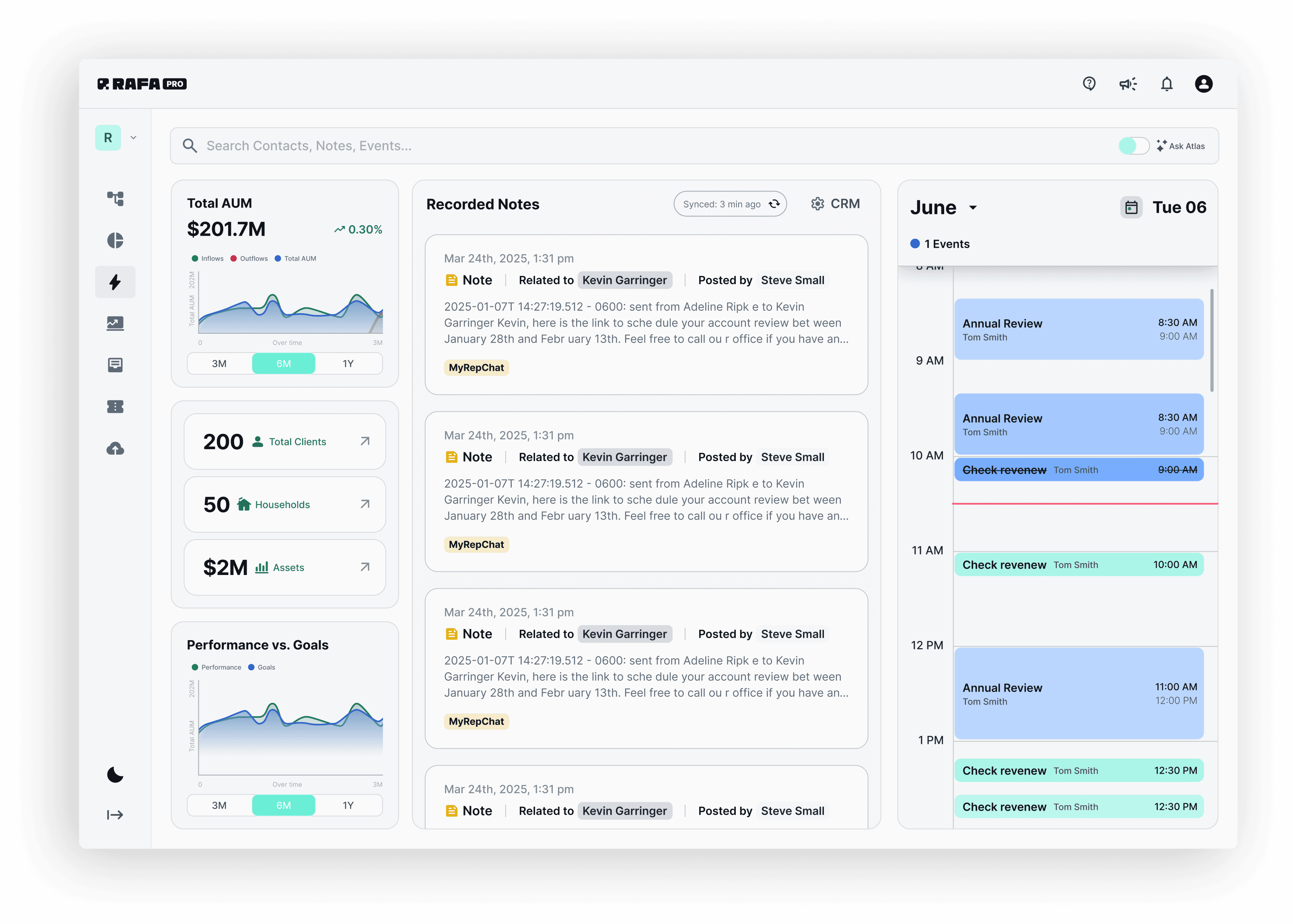

Over the past year, I designed RAFA PRO, a B2B investment AI-powered platform for financial advisory firms. Starting from a B2C foundation, I evolved the product through continuous testing and iteration. Seven months after official launch, the platform now serves 50+ firms.

The Challenge

After a year working on a B2C mobile app, my role pivoted to designing a B2B solution. This meant different users: from individual investors to financial advisors managing multiple client portfolios.

With limited time for initial research, I needed to learn through building. The approach: build, test, evolve. Rather than spend months in research, we built a strategic first version to test with real advisors, then iterated based on their feedback.

Research

Limited research doesn't mean no research. I interviewed two advisors to understand their daily tasks, goals, and pain points.

The Key Insight

Unlike individual investors focused on their own wealth, advisors juggle multiple client needs and prioritize relationship management over deep analysis.

The Solution

To build a quick first version, I made strategic decisions:

Start from B2C foundation: Adapted components for speed but made key changes: removed the focus from stocks and portfolio to a dashboard-first experience, since advisors prioritize overview and urgent tasks over deep-dive analysis.

Embed feedback mechanisms: Built feedback tools directly into the product to capture real-time insights as advisors used it.

Prepare the information architecture for rapid iteration: Ensured rapid iteration didn't compromise the product's overall organization and structure.

Starting from the B2C mobile app, here's what the strategic first version looked like.

Testing & Iteration

Once we had a working first version, testing began. I used a mixed approach: user testing sessions to observe behavior, and in-app feedback tools to capture thoughts as advisors adapted to the platform.

Portfolio Evolution

As advisors loaded their client portfolios, problems emerged. Navigation felt cumbersome, they had to scroll through long lists and click into each portfolio just to see what needed attention. The deep-dive analysis we offered held little value; they needed quick overview and fast action.

The transformation:

Table layout replacing list view: Shifted from showing full portfolio details upfront to a scannable table highlighting key data advisors actually need at a glance.

Detailed view on demand: The deep-dive portfolio analysis still exists, but now opens as its own page when needed, rather than cluttering the main view.

Smart search over chat: Pivoted the AI from conversational queries about individual portfolios to organization-wide search. Advisors can now ask Agent Atlas questions like "Which clients need monthly review now?" across all their portfolios.

Bulk actions: Added multi-select capabilities so advisors can run actions and workflows across multiple portfolios at once, saving significant time.

Light mode: Noticed advisors preferred light themes over dark mode, so I added a theme toggle and tokenized our color system for seamless switching.

Where We Are Now

One year from first designs to 50+ advisory firms actively using the platform.

The Concurrent Investment Advisors partnership brought significant scale, and the platform continues to evolve based on daily user feedback.

"As the Chief Product Officer at RAFA PRO and former Portfolio Manager/ Equity Analyst, explaining complex financial topics and solutions has always and will continue to be one of the most difficult challenges. I thought delivering on that promise was impossible. Martin not only made the impossible possible, but his designs single handedly helped us bring in a massive enterprise contract.

He's always available, has an incredible "can do" attitude, and ability to constantly deliver above and beyond what is asked for is a talent that cannot be taught. Working with Martin is one of the most incredible privileges I've had in my professional career."

Brian Bonewitz, CFA

Chief Product Officer at RAFA | Former Portfolio Manager/Equity Analyst